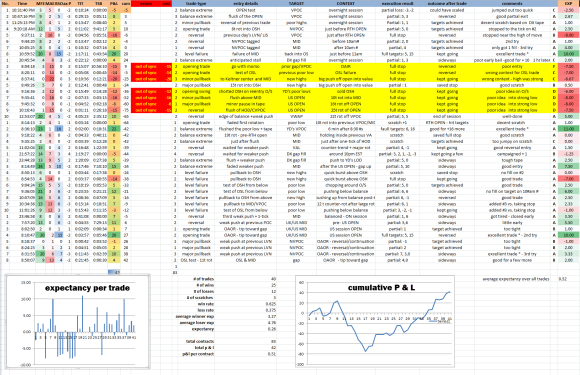

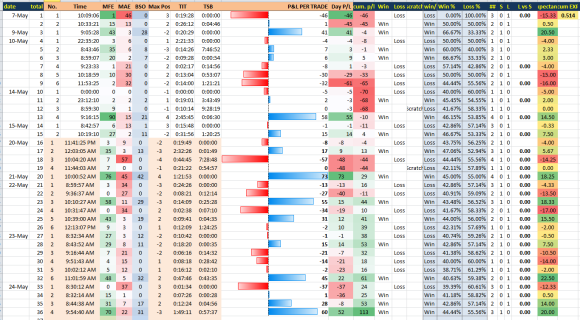

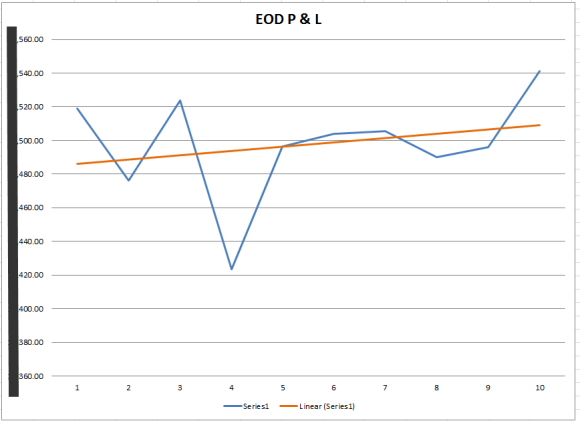

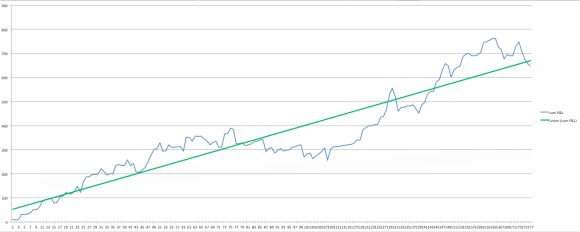

results for 11/18/13 – 11/22/13:

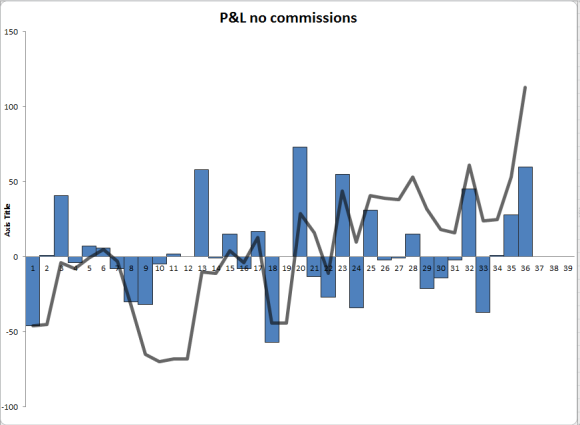

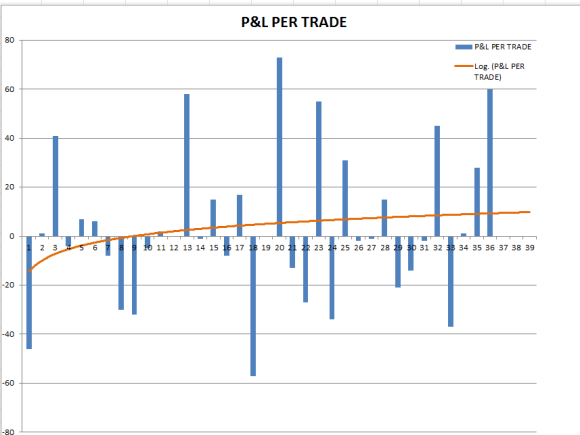

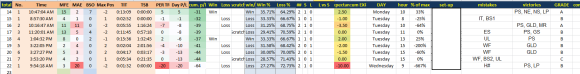

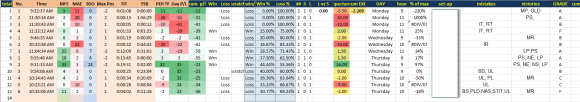

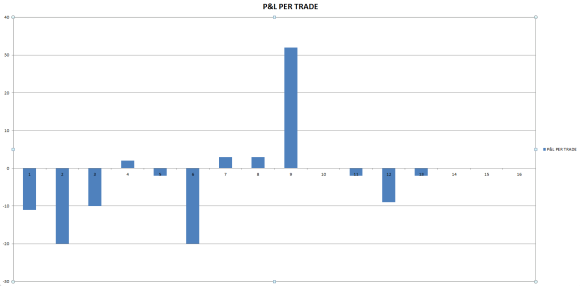

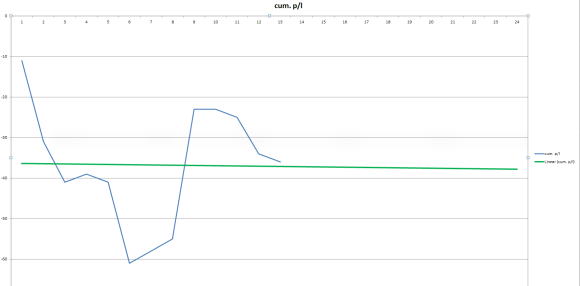

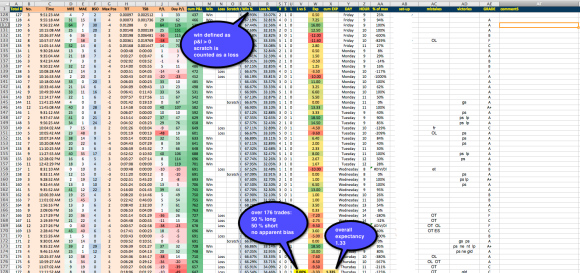

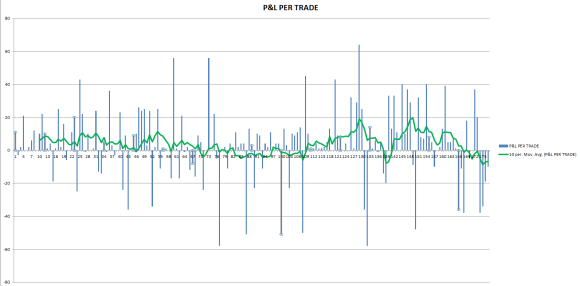

Tuesday’s results were unusually poor. I chose to give numerous tries to my new way of approaching entries. As it turned out I was totally out of sync and my trading amounted to donations to the market. The 7 losers were taken consciously, though, and I did examine all my trades and saw clearly why they did not work afterwards. It seemed to give me some good lessons about how to actually implement my new strategy.

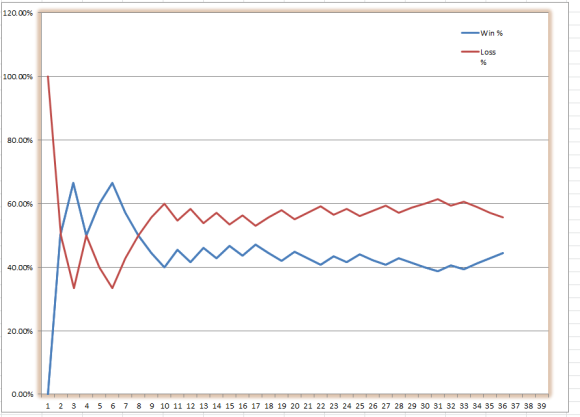

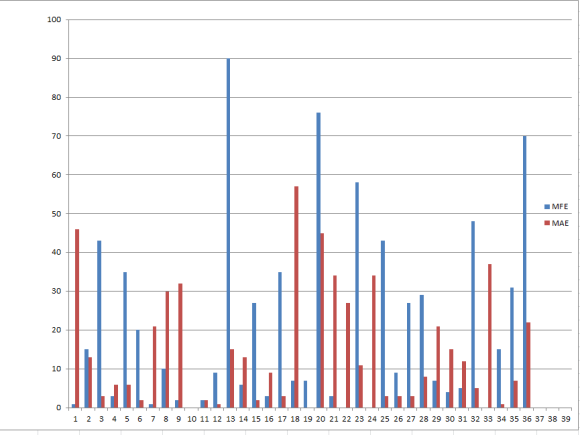

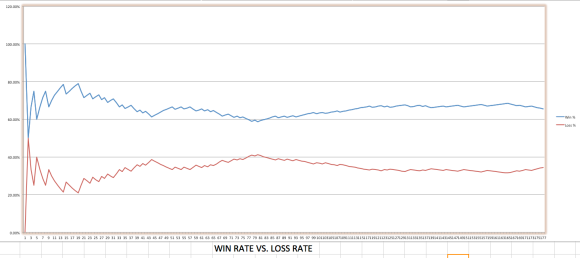

The results the rest of the week support this theory. I only had one full stop-out over the next 24 trades. My trading was excellent in general. The main shortcoming was scratching numerous trades that wound up working. But the win rate was very high.

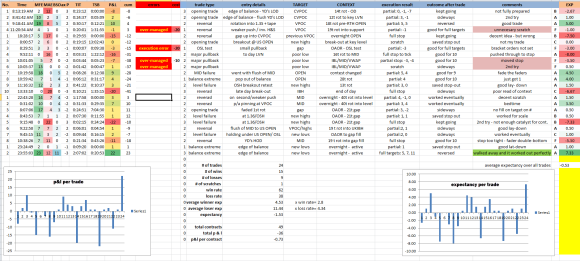

goals:

Next week I intend to continue doing what was working so well on Wed/Thu/Fri last week. Specifically, following the trade-stalking process and taking trades that go WITH a shift in momentum rather than trying to anticipate the shift. I will also work on scratching fewer trades unnecessarily.

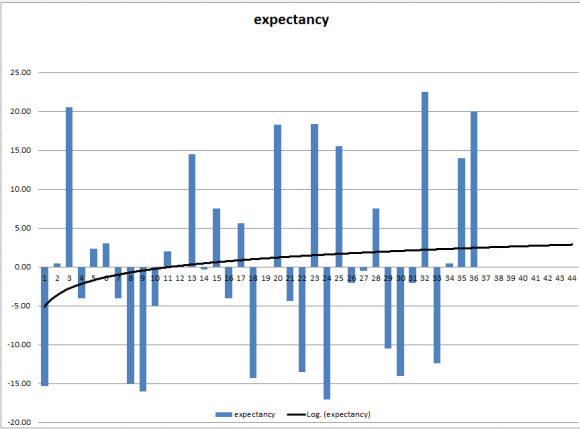

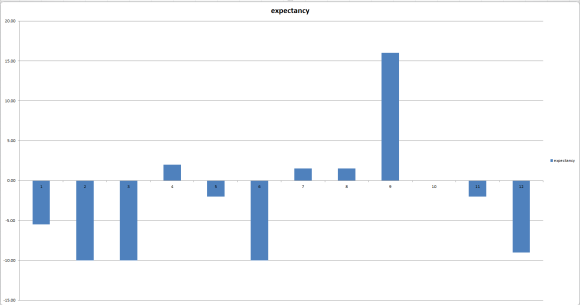

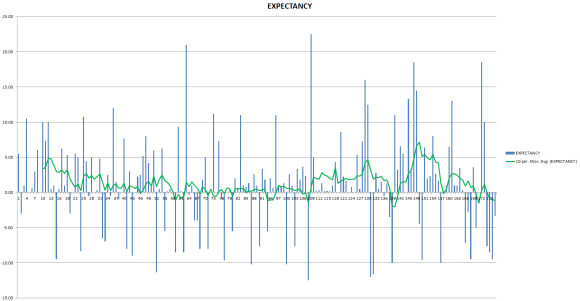

expectancy baseline = .26 expectancy goal for next week = 1.25 per trade

_________________________________________________________________________________

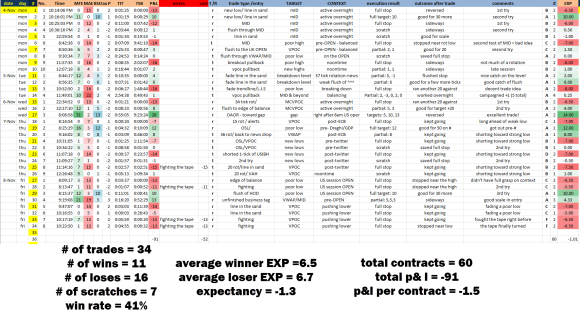

results for 11/25/13 -11/28/13:

observations:

i didn’t achieve my goals for the week. i only had one trade achieve full targets.

my error trades negated most of my expectancy goal.

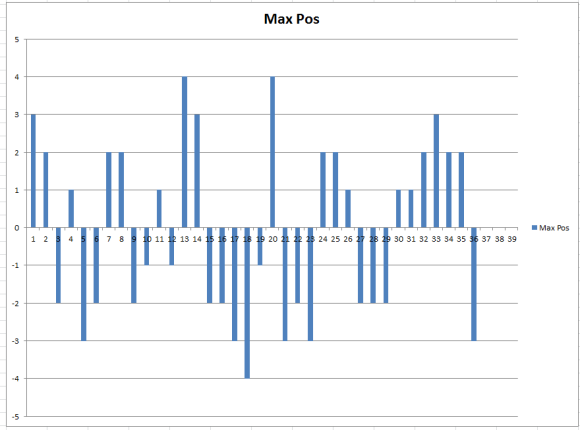

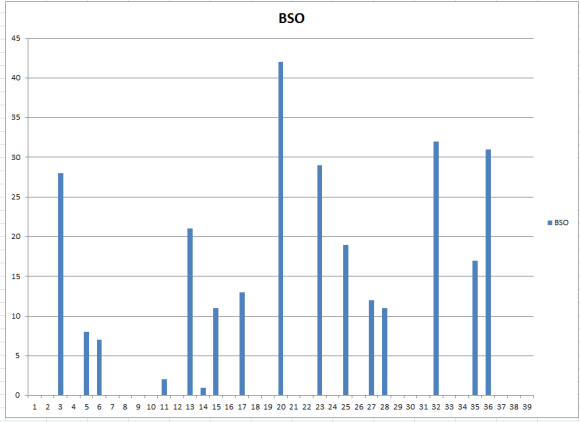

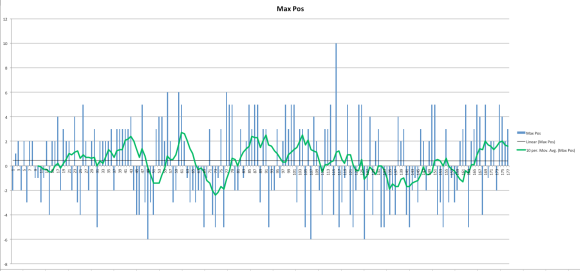

I am scratching trades too aggressively. Too often I am allowing the “final pullback” to shake me out just before the move actually works out. I am reading the tape too closely after my entry. Eventually, this is where I should be campaigning to reduce risk, but for now I need to improve on taking decent entries and letting the trades play out.

my new way of reading/entering the market does seem to have potential… the key is improving my execution.

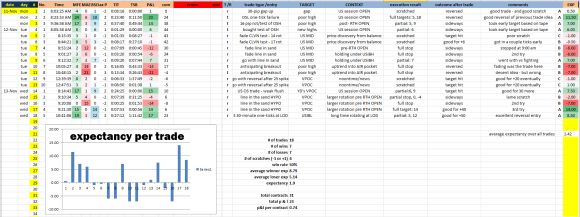

goals for next week:

expectancy per trade = 1

0 poor scratches

all trades according to my process